What are Closing Costs?

Closing costs are the fees and charges that are due to the buyer and the seller during the final stage of the home purchase process, which is aptly called the closing or settlement. It is also at this stage that both parties sign the final ownership and insurance paperwork. Generally, the buyer is responsible for most of the closing costs, but they may negotiate with the seller to cover some of these. Closing fees and legal requirements would differ depending on the state and the municipality of the property purchased, so it is best for homebuyers to learn about these before they make their offer to the seller.

Average Closing Costs in The Triangle

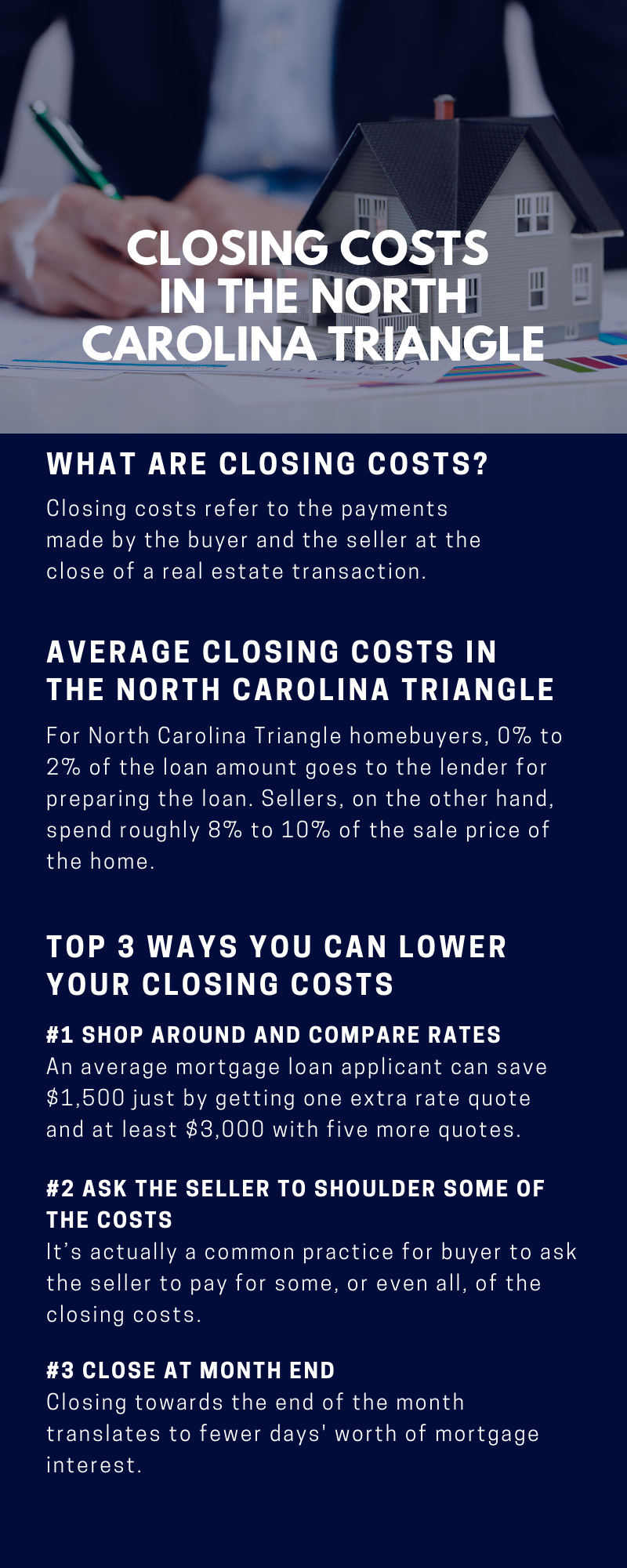

For North Carolina Triangle homebuyers, 0% to 2% of the loan amount goes to the lender for preparing the loan. Tax service fee costs around $75, $18 is spent for flood certification, and credit report fee may range from $20 to $200, depending on their credit score. Aside from lender fees, buyers would also have to pay third party fees, such as title insurance, which costs $2.50 per $1,000 of the purchase price of the loan. Other third party fees include attorney fees, which cost $900 on average; $100 in recording fees, which is paid to the county government to record the legal documents; $475 to $525 for appraisal fees; and $20 or less for a tax transcript.

Sellers, on the other hand, spend roughly 8% to 10% of the sale price of the home. This would amount to around $17,000 to $22,000, based on the nation’s median home value of $217,000. Of this amount, about 6% of the home value is paid to the buyer and seller’s agents in commissions, both receiving 3%. Then 2% to 4% goes to several different taxes and fees. Escrow fees are paid by both buyer and seller, and can be a flat fee or a percentage of the home sale price, usually approximately $500 and $2,000 for a flat fee or 1% of the home sale price if charged as a percentage of the sale price.

Breakdown of Closing Costs in North Carolina

Closing Costs for North Carolina Triangle Homebuyers

Buyer’s closing costs are broken into three sections:

- Loan Origination Fee

- Tax Service Fee

- Flood Certification Fee

- Credit Report Fee

- Title Insurance

- Attorney Fees

- Recording Fees

- Appraisal Fees

- Tax Transcript

- Interim Interest

- Escrow Account

- Homeowner’s Insurance

Closing Costs for Sellers in the North Carolina Triangle

- Agent Commission

- Transfer Tax

- Title Insurance

- Escrow Fees

- Prorated Property Taxes

- HOA Fees

- Credits Toward Closing Costs

- Attorney’s Fees

Tips for First Time Homebuyers Who Want to Reduce Their Closing Costs

If you are a first time homebuyer in the North Carolina Triangle area, you may find the list of closing costs a bit too overwhelming, but keep in mind that everything on this list can be negotiated with the lender and the seller. In addition, you can do a few things to significantly lower your closing costs. Here are some practical tips to help you get the best deal out of your first home purchase:

1. Work with a Broker That Gives a Rebate

Aside from asking your broker to lower their broker’s fee, you can work with one that offers a rebate on their commission. Some homebuyers opt to do some of the legwork themselves in exchange for a percentage of the commission that is paid to the broker at closing. One such activity that you as homebuyer can do yourself is view properties on your own without a broker with you.

2. Understand the Fees and Charges in Your Closing Costs

The best way for you to be able to negotiate for the best deal is to equip yourself with pertinent information regarding the settlement of your home purchase. Do your own research about the various fees and charges involved at settlement so you would learn which ones are not necessary and can be taken out of the list and which ones can be negotiated to be reduced. For example, certain taxes like the mansion tax are not applicable to all home purchases. If the property that you are buying is less than $1 million, then you will not be required to pay this tax. Knowing this becomes particularly useful if the home sale price of the property is a little over the applicable rate, and you can negotiate for a lower selling price, so you won’t have to pay this tax.

3. Compare Quotes from Different Lenders

The secret to getting the lowest mortgage rates is to shop around. Apparently, competition is quite high among mortgage bankers and they are most likely to lower their rates just to get your business. By requesting for a quote from two lenders, you can actually save as much as $1,500 and at least $3,000 if you get five more quotes from different lenders.

4. Schedule Your Closing Date Towards the End of the Month

One more strategy for reducing your closing costs is to delay your closing date and schedule it towards the end of the month. There are certain closing costs, such as prepaid daily insurance charges, which are calculated based on the number of days between the closing date and the start of the following month. So, when you schedule your closing date towards the end of the month, the number of days being counted are less and you consequently lower your cash outlay for prepaid or “per diem” interest. To compute for your savings, multiply your loan amount by your interest rate and divide the result by 365 to get your daily interest charge, then multiply this by the number of days left in the month.

Buying your next home in the North Carolina Triangle area need not be a stressful one. I can help you throughout this process from start to finish, and show you all the best options available for you in this wonderful location. Feel free to give me a call at 919-452-6484 or send me an email at nate@hgrnc.com.